- Deloitte reaffirms in its audit the data advanced by the group last January.

- Parlem, which has achieved a positive operating cash flow for the first time, has increased its revenues by 9.5% compared to the 2023 financial year and has grown its recurring EBITDA by 80%.

- The forecasts for 2025 are €54 million in revenue with a 9% growth, a 16% increase in EBITDA, and a positive net result for the first time in the history of Parlem Group

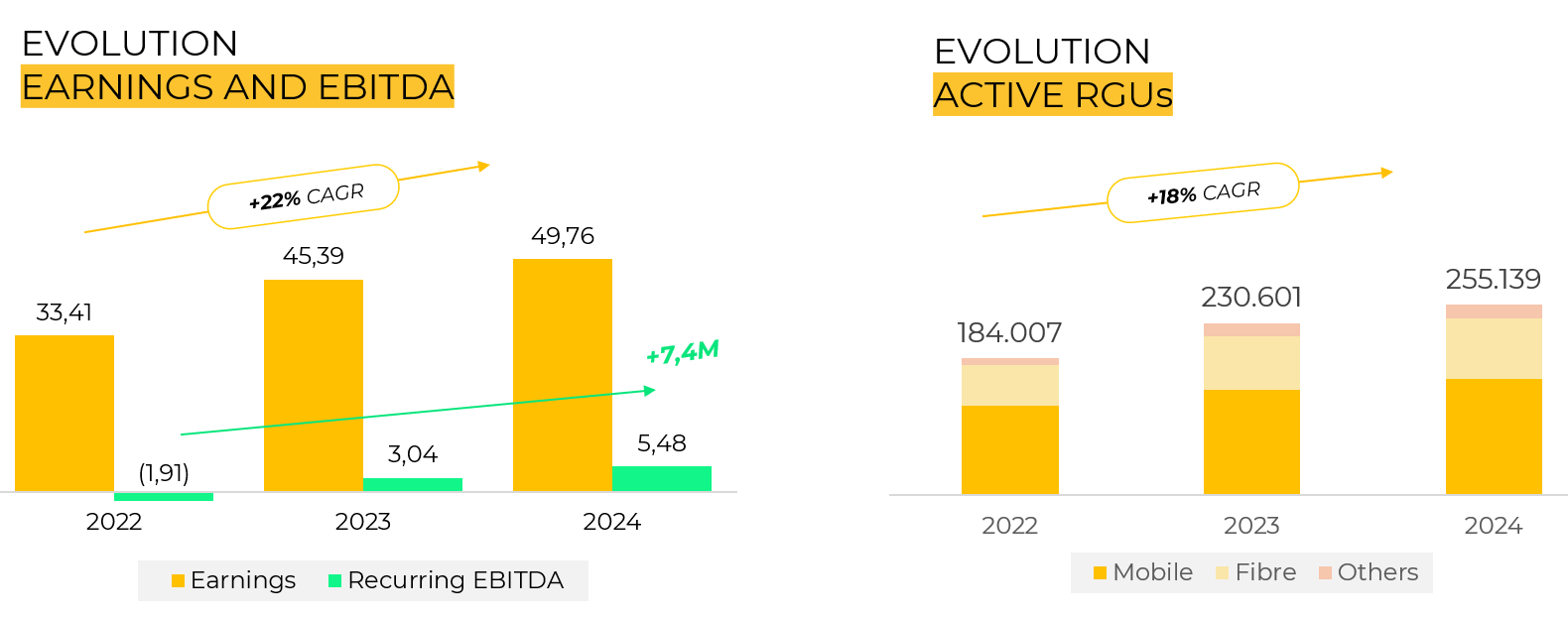

Parlem Group has closed the 2024 financial year with results that confirm the positive evolution of the business and the achievement of strategic objectives. The company has reached revenues of €49.7 million, a 9.5% increase compared to 2023, and a recurring EBITDA of €5.5 million, 80% higher than the €3.04 million of the previous year. This growth, validated by Deloitte, confirms the results advanced in January.

For the first time, the group has recorded positive operating cash flow (+€899,568), with an improvement of more than €1.7 million compared to 2023. Also notable is the positive operating result of Parlem Telecom at an individual level (€1 million), improving by over €1.4 million compared to the previous year.

In just two financial years, the Group’s revenues have grown by 49% (from €33.4 million in 2022 to €49.7 million in 2024), while recurring EBITDA has improved from -€1.9 million to €5.5 million, a €7.3 million improvement. This structural change reflects the effectiveness of the restructuring measures and operational efficiency implemented.

By the end of 2024, the Group achieved 97% of its revenue guidance and 95% for recurring EBITDA, demonstrating strong execution and a high level of alignment with its forecasts.

In terms of commercial performance, the Group has surpassed 255,000 active services (+10.5%), driven by growth in fiber services (+13.9%). ARPU has increased to €37.73 (+2.3%), and churn remains at 1.5%, positioning Parlem as one of the operators with the best customer retention in the market. Additionally, the OCU (Organization of Consumers and Users) has once again ranked Parlem among the most highly rated operators by consumers.

Parlem Group has strengthened its territorial structure with the acquisition of the telecom unit of Pinergia (Xartic brand in the Pyrenees and Cerdanya). Furthermore, on March 28, the sale of the energy division Ecolium to Solfy Renewables was completed, allowing the group to focus exclusively on its core business of telecommunications and digital services.

During 2024, Parlem secured financing totaling €10 million. In addition to this, a new €5 million credit line was established with Andbank (Andorra Banc Agrícol Reig, S.A.), formalized on March 31, which will help drive organic growth and potential future inorganic operations.

Internally, the Group has announced the implementation of a 37.5-hour workweek starting in 2025, anticipating regulatory trends and reinforcing its commitment to work-life balance and talent attraction.

On the stock market, Parlem’s share price has increased by 17.4% during 2024, reaching €3.30, with analysts forecasting a potential 37% revaluation.

Looking ahead to 2025, Parlem forecasts revenues of €54 million (+9%) and a 16% increase in EBITDA, with a positive net result expected for the first time in its history.

These results and outlook position the Group as a benchmark in the telecommunications sector, with a strategy focused on customer satisfaction, operational profitability, and management efficiency, standing out for its proximity, quality, and innovation capacity. All of this lays a solid foundation for continued steady progress.